The private companies making inroads into NHS care – in screening, scanning, testing and imaging

Investment bankers always have an eye on where big profits are to be made, and one of those areas, unfortunately, is in the treatment of the sick. What they see as the health ‘market’ in the UK is being watched closely by investors, bankers and entrepreneurs as the NHS structures that once prioritised treatment are being altered to prioritise profit, and the legal barriers to privatisation fall.

Morgan Stanley announced in March of this year three areas that ‘investors may find especially compelling’; they were genomics, biotech and diagnostics.

I was curious about diagnostics providers in the area I live in, so I sent four FOIs to the four hospital trusts in Kent and Medway asking about private providers of these services.

The replies showed that 15 different private companies are offering 13 different diagnostic services in the NHS in this location. Here are the results in a table:

Here are the results by Trust:

Medway NHS Trust – 5 private providers

– Endoscopy: 18 Weeks Support Ltd and the Practice Plus Group. ENT: HBS. Imaging: Currently outsource CTVC to The Spire. Respiratory: CPAP set up has been outsourced to Dolby Vivisol with effect from 11 May 2022.

Maidstone & Tunbridge Wells NHS Trust – 8 private providers

CT and MRI via our Community diagnostic centre: Inhealth Ltd. Echocardiography: some insourced activity with Elective Services. Medical Imaging Partnerships provide DEXA, MRI and Ultrasound. Spire Tunbridge Wells provide MRI. Nuffield Tunbridge wells provide MRI. Lyca Health provide MRI. Agito provide CT, and MRI PET CT is provided by Alliance Medical. Open MRI are done at InHealth specifically for obese or claustrophobic patients.

East Kent Hospitals University NHS Foundation Trust (EKHUFT) – 7 private providers

- Inhealth Ltd provide CT Scans and MRI.

- Cardiac Services – BMI Circle.

- Radiology Reporting – 4ways Healthcare.

- Endoscopy – Healthshare Limited, 18 Weeks Support.

- MRI – Healthshare Limited.

- PET – CT Alliance Healthcare.

Dartford & Gravesham NHS Trust – 1 private provider

– Alliance Medical provide – PET-CT

18 Week Support Limited, and ‘insourcing’…

I picked one of the companies at random and took a closer look.

18 Week Support describes itself as a ‘bespoke insourcing service’. On Companies House, the company is listed as a private limited company, and its accounts show £560,000 paid out in dividends to the company’s owners in 2021. The company has contracts with 80 out of 172 NHS Trusts in the UK, covering 162 different NHS contracts. The company accounts state that ‘endoscopy continues to deliver the highest revenues’ and the ‘sales pipeline is very strong with over 200 leads totalling £47 million in our CRM’. In other words they intend to grow aggressively and bag another £47 million of NHS business in the near future.

Who owns 18 Week Support Ltd?

Companies House shows that the firm is owned via a chain of holding companies by ‘Tower 18 Topco’, whose directors include three Investment Bankers at Summit Partners, an American Private Equity firm with offices in London. The owners of this private limited company appear to be the directors, i.e. the three bankers and two company founders.

What service does the company provide, and what is ‘insourcing’?

Insourcing in the NHS is when a private firm provide extra staff for certain procedures or departments. These non-NHS staff work alongside existing NHS in the hospital for limited periods of time. It is a form of outsourcing, except the work is done inside NHS facilities and alongside NHS staff. The name 18 Week Support is a reference to the RTT targets (referral to treatment targets) set out in the NHS constitution – it states that 92% of elective care should happen within 18 weeks of referral. 18 Week Support Ltd offers to enter hospitals when they have ‘spare capacity’, i.e. at quiet times such as weekends, and boost staff levels to help to deliver on meeting backlogs in the following areas: vascular surgery, general surgery, ophthalmology and dermatology. CEO Alex Chilvers argues that their service costs less to NHS trusts than private hospital providers, who presumably provide outsourced services on their own sites.

The service 18 Week Support is providing in Kent is endoscopy.

Is this privatisation?

Yes. Companies like this hire staff (many of whom will have been trained in the NHS; many will still be working for the NHS) and effectively rent them back to the NHS. The company is a profit making entity and partly owned by investment bankers. In the short time they have been operating, they have already extracted £560,000 in dividends. When the company expands aggressively (as its accounts reveal it intends to) it will be extracting much larger sums in profit. This company’s business model is to provide services to the NHS only, so what it is doing is eating up money from the NHS budget and providing a service, but also creaming off a percentage in profits that end up outside the NHS, creating additional wealth for investors. The firm presents itself as a helping hand to the NHS, but in reality services like this are either reducing the NHS staffing pool or are using full-time NHS staff on their days off. It is either drawing capacity away from the NHS’s main staffing pool or redirecting clinical staff hours toward elective care and away from emergency care, and potentially adding to staff burnout.

It also reduces the amount of public money that reaches frontline care, as it siphons off a proportion of public funds into private hands.

The NHS Support Federation explains – “Insourcing – inviting a private business to carry out work on the trust’s premises – is now a rapidly growing way for private healthcare to generate revenue from the NHS … The NHS insourcing market is one of the fastest growing markets in private healthcare, in the 2019 financial year it was worth £44m, by FY2021 it had reached £95m, and is predicted to rise to £139m in FY2022 and £295m in FY2024.”

Those who think privatisation of the NHS is a ‘conspiracy’ are not looking too closely, or are being deliberately obtuse – seeing only a wholesale ‘Don’t tell Sid’/British Gas style sell-off as the only definition of privatisation.

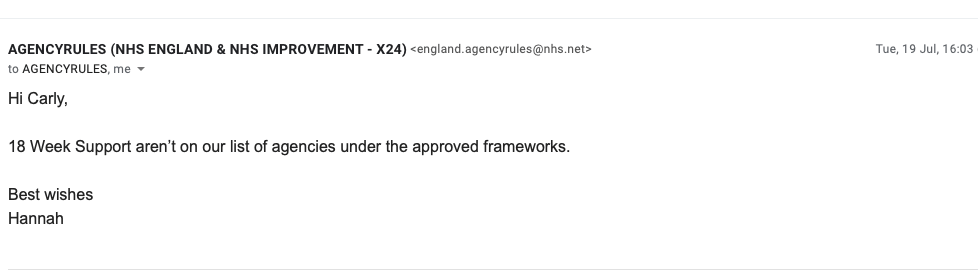

Edit: I contacted NHSE about 18 Week Support Ltd to check if they were on the approved list for insourced support. They are not. 21.07.22.

Carly Jeffrey, 18 July 2022.